The UK Coffee and Sandwich Shops market is witnessing significant changes, driven by evolving consumer behaviours and economic conditions. In this article, we delve into the current market landscape, providing detailed insights into the market size, growth trends, and share statistics for 2024.

Market Overview

The UK Coffee and Sandwich Shops market has experienced notable shifts in recent years. Key trends and statistics highlight the sector’s dynamic nature:

- Increased Drink-Only Occasions: The share of drink-only occasions grew by +1.3ppts, reflecting more consumers seeking necessity-driven outings.

- Rising Popularity of Coffee and Sandwich Shops: These establishments saw a +2.2ppts increase in occasion share, driven by the uptick in drink-only occasions.

- Economic Factors: Eased cost of living pressures and a return to habitual routines have encouraged more consumers to purchase drinks from coffee shops while out and about.

Market Size

The UK Coffee and Sandwich Shops market has shown robust growth, with notable increases in market size over recent years.

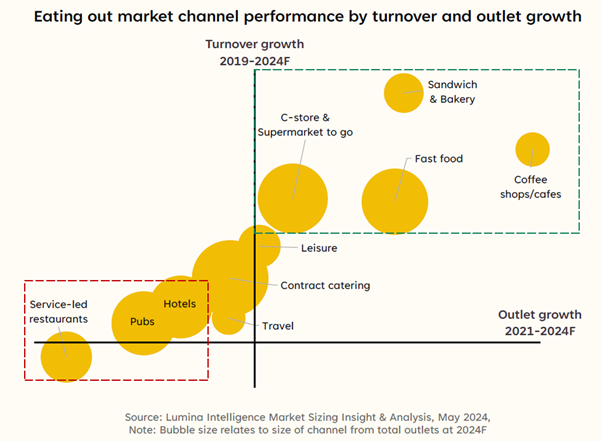

Sandwich & bakery channels and coffee shops/cafés have achieved value growth of +32% and +24%, respectively, from 2019 to 2024.

The market continues to grow, driven by physical expansion, technology-led innovation, and consumer-aligned new product development.

Market Growth

Several factors have influenced the growth of the UK Coffee and Sandwich Shops market:

- Economic Conditions: As cost-of-living pressures ease, more consumers are returning to their pre-pandemic routines, including frequenting coffee and sandwich shops.

- Consumer Preferences: The increasing preference for drink-only occasions has boosted market growth for players innovating in the category and driving spend through more premium ranges.

- Future Predictions: The market is expected to continue its upward trajectory, with key players investing in digital innovation and expanding into new formats like drive-thrus and travel hubs.

Factors Influencing Growth:

Digitalisation continues to be an ongoing trend, with enhanced loyalty programs and digital innovations attracting more consumers with perks and ease-of-use.

Expansion into travel hubs and grocery spaces is also providing new growth avenues for brands like Starbucks and Greggs, as well as airport outlet expansion.

Market Share

The market share dynamics among key operators and convenience types are evolving:

Bakery favourite Greggs is set to grow its outlet share by +1.2 percentage points in 2024, dominating the bakery and sandwich segment. Starbucks is expected to increase its share of coffee shops by +1.1 percentage points through drive-thru expansion.

In conclusion, the UK Coffee and Sandwich Shops market is poised for continued growth, driven by changing consumer behaviours, economic recovery, and strategic innovations by key players. As drink-only occasions rise and more consumers frequent coffee shops, the market’s future looks promising. Stakeholders should focus on leveraging digital innovations and expanding into new formats to stay competitive in this dynamic landscape.