The Lumina Intelligence Restaurant Market Report 2020/21 is the definitive report for the UK restaurant industry. Our market forecasts comprise three scenarios for what recovery for the sector in 2021 could look like and we put the data in context with commentary from business leaders as well as validation from external performance barometers.

£3,250

The most comprehensive overview of the UK restaurant market

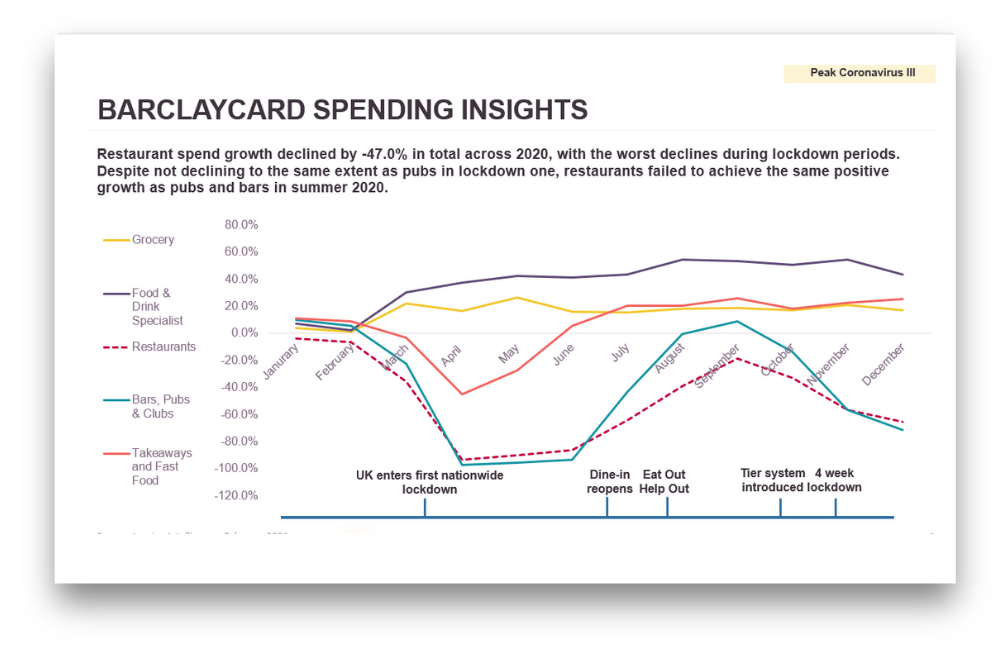

- A timeline of key events over the last 12 months

- An overview of the restaurant market landscape and key sub-sectors, including market sizing and growth (benchmarked vs total eating out market)

- Restaurant market drivers and inhibitors

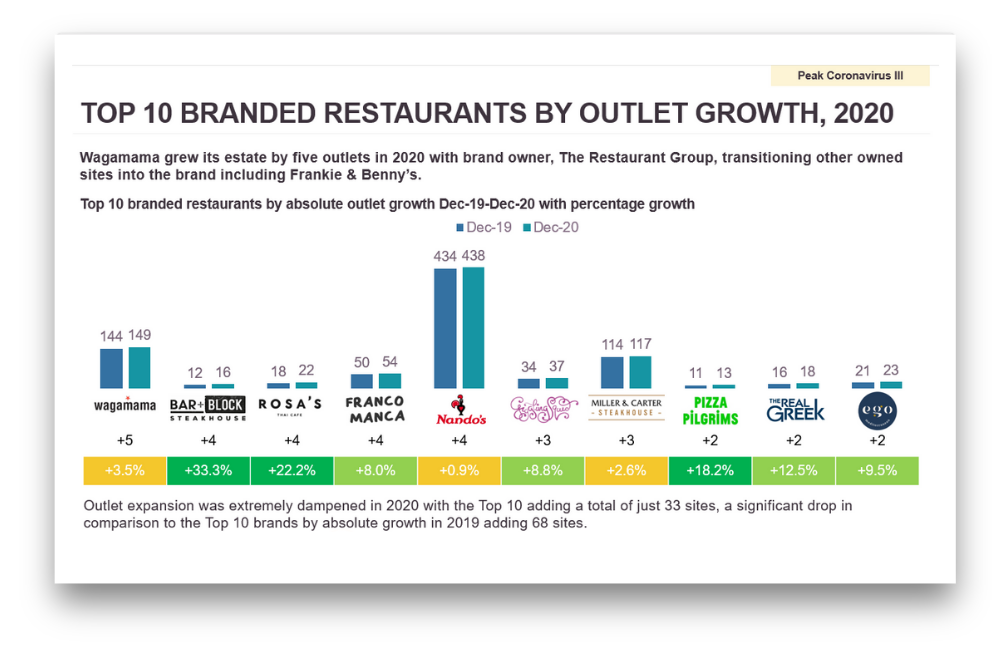

- Detailed analysis of leading restaurant brands (including quantification of outlet decline)

- Market developments (including operator innovation in the face of the pandemic)

- M&A activity across the sector

- Rankings of branded restaurant players

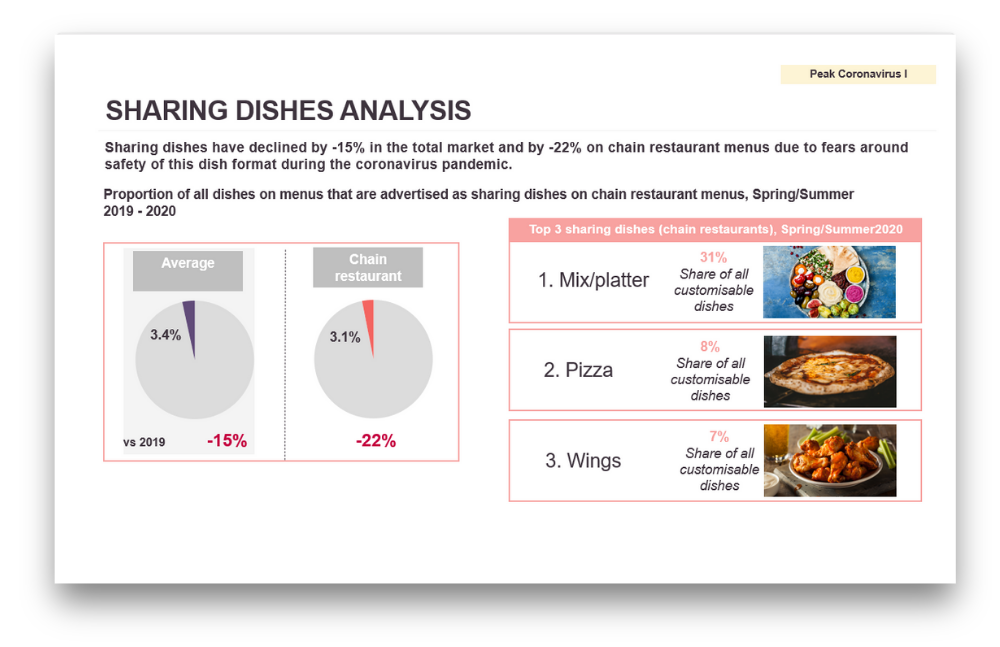

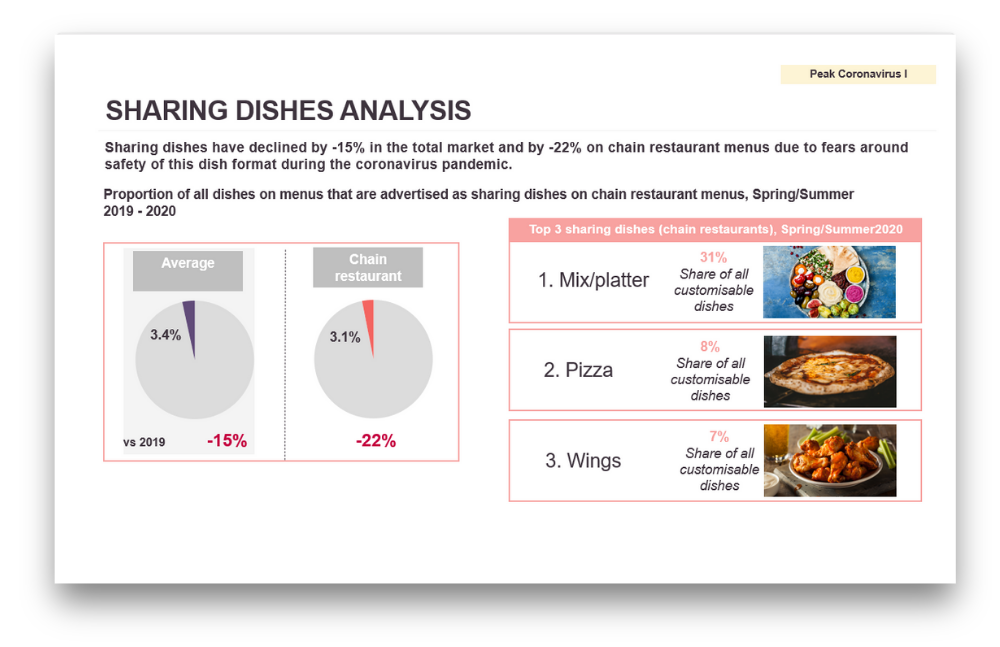

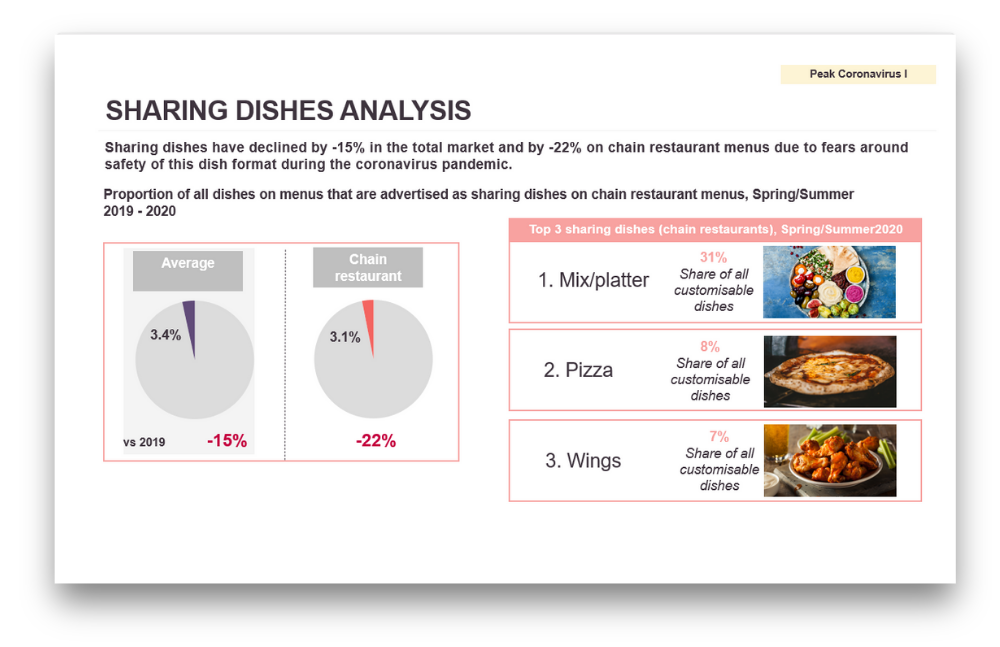

- Product and price analysis of restaurant brand menus to understand changes, by course, in:

- Dish counts

- NPD

- Pricing

- Cuisine

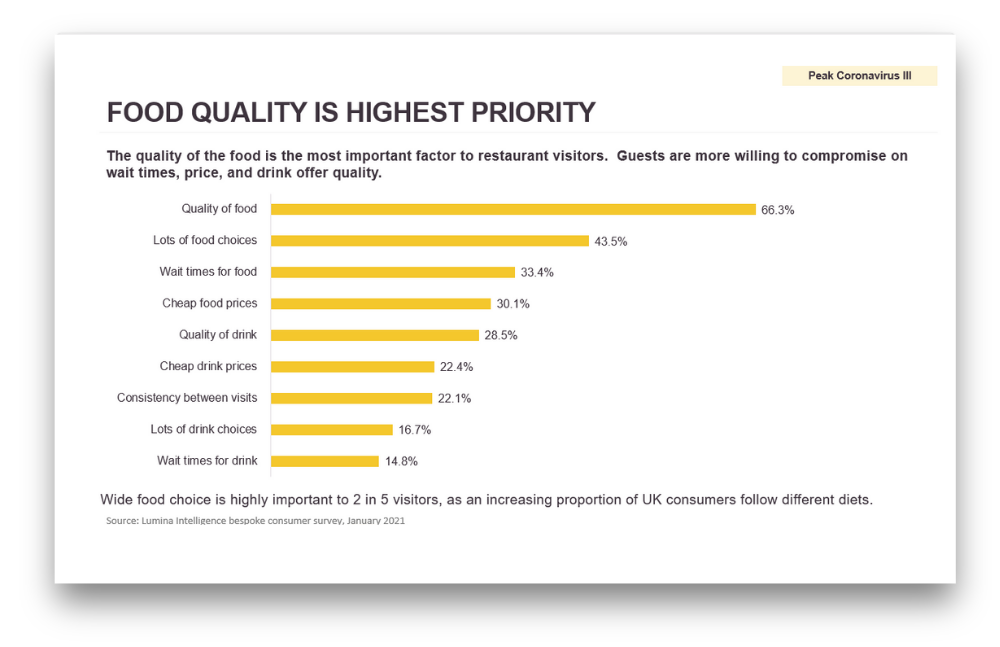

- How have consumers responded to limited options for ‘eating out’. The report analyses:

- Consumer demographics

- Where consumers go to ‘eat out’

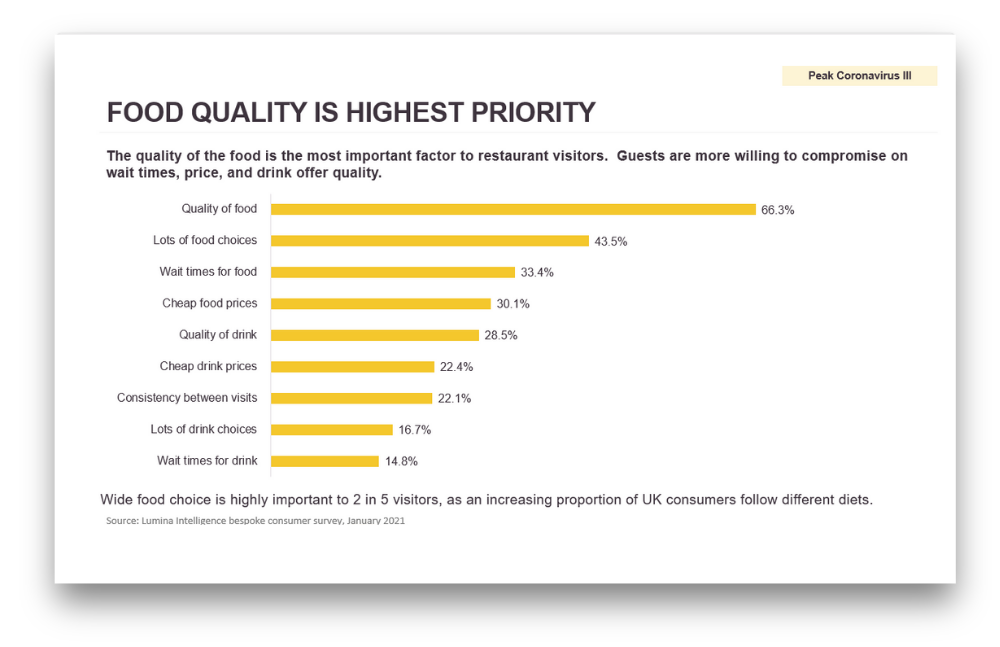

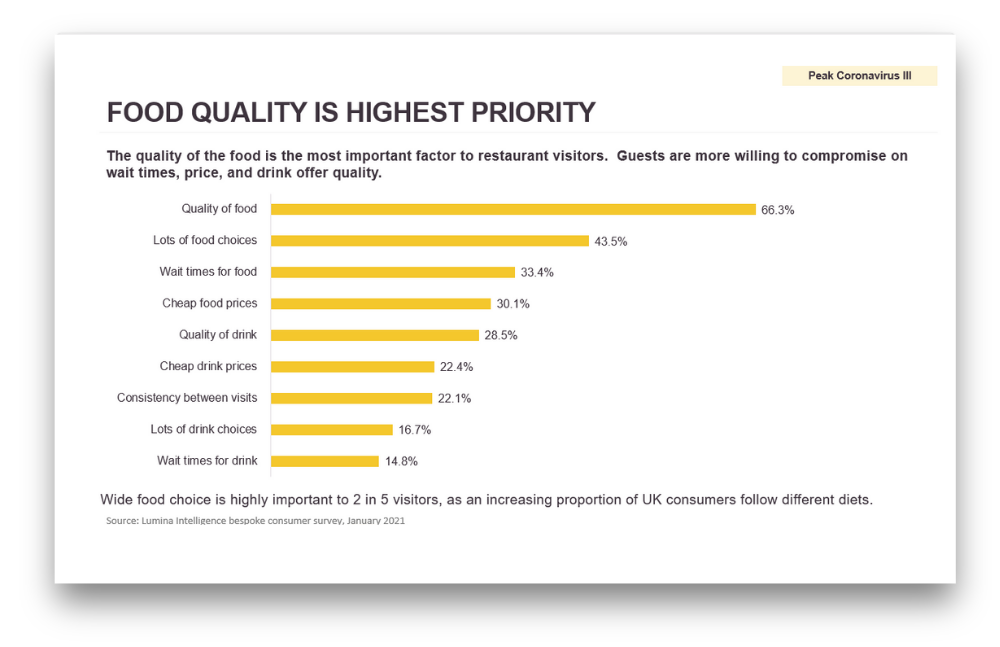

- Why they choose a specific outlet

- How often they ‘eat out’

- What they purchase

- Barriers to purchasing

- Analysis on the desire of consumers to return to hospitality.

- Three scenarios for restaurant performance in 2021 based on different restrictions across the year

- Market concerns and market opportunities

- Key levers of sales growth for restaurants

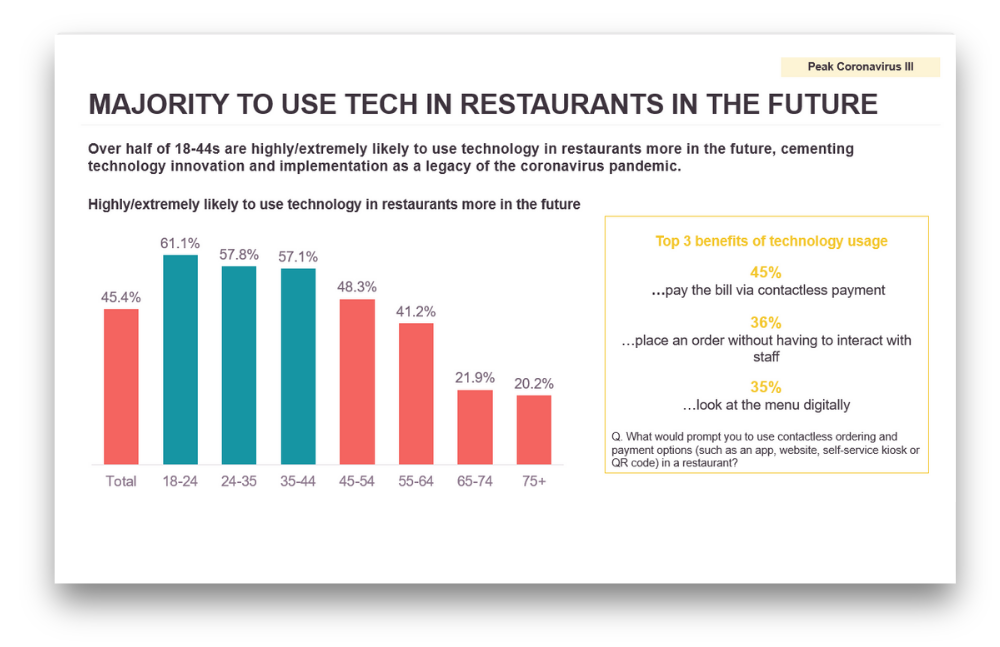

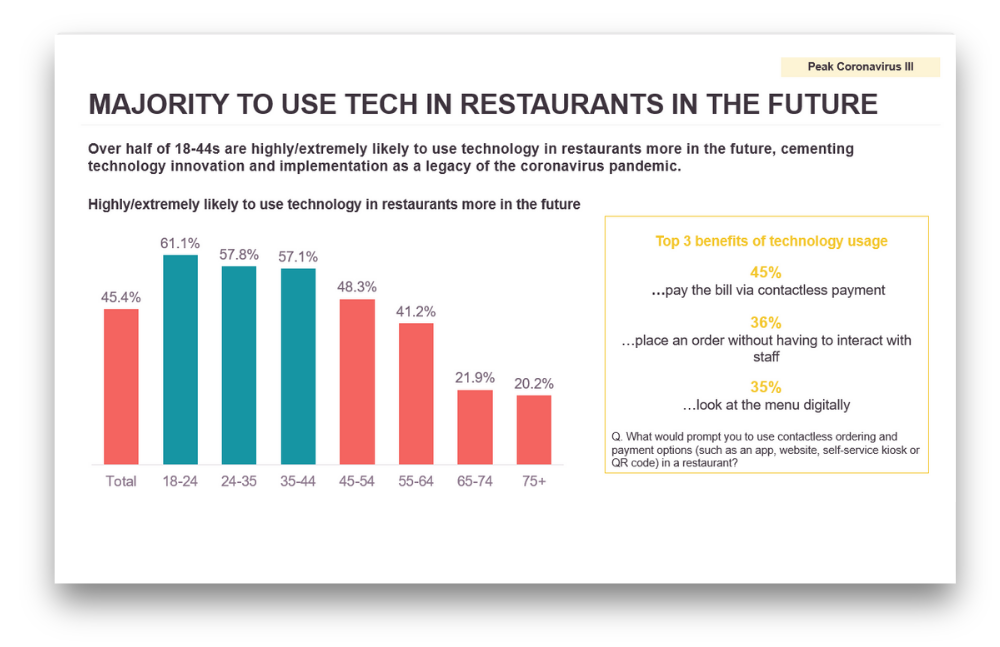

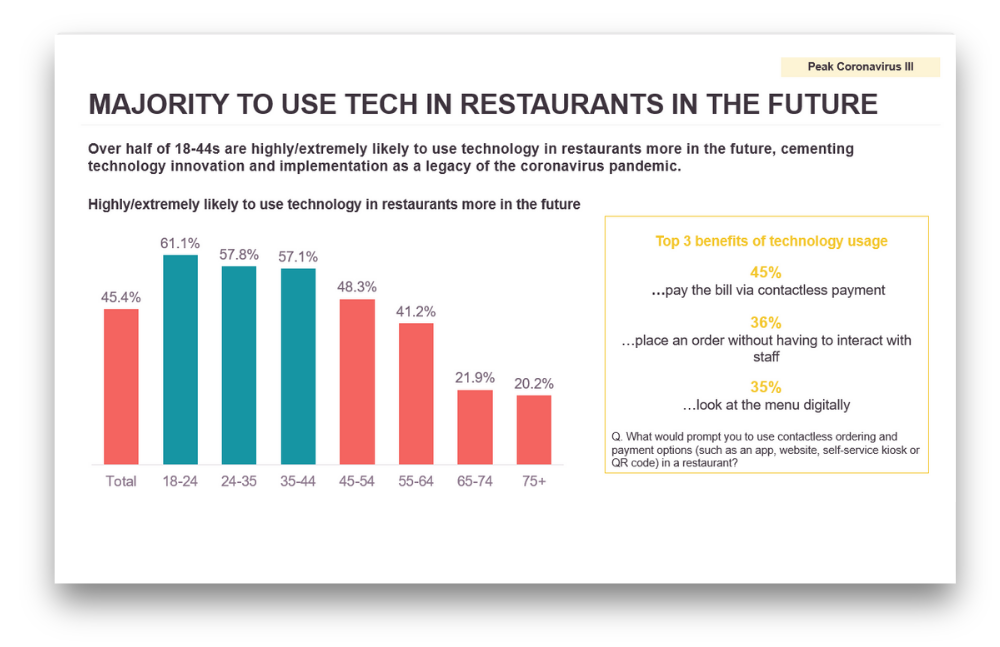

- Consumer appetite for technology in restaurants

One report, covering the whole year

Three market recovery scenarios

Since the start of the pandemic, the future has been challenging to predict. Numerous lockdowns, tiers and restrictions have scuppered glimpses of positivity surrounding market recovery. As a result, our analysts have produced three difference market scenarios for 2021 based on differing government restrictions and implications for hospitality. Leading impacting factors include the efficiency and uptake of the vaccine rollout as

well as further government support to kick start consumer spending post lockdown.

Quarterly updated consumer insight

How consumers behave pre, post and during lockdown periods is very different, which is why we will be providing quarterly updates of the consumer insight section of the report. So, rather than receiving a snapshot on consumer trends, you will recieve data that reflects the entire year, enabling you to understand how consumers are behaving throughout the year and build a strategy that evolves based on current consumer trends.

These updates will be automatically sent to you every quarter.

A robust read of delivery and click & collect

For most operators, dine in operations have remianed closed longer than they have been opened since March 2020. This has limited operators to three potential footfall streams – takeaway, delivery and click & collect. Understand the behaviour of consumers towards these three footfall streams and understand their impact on market recovery. How can you use each of them to target different consumer demographics?

How can delivery and click & collect work in sync with dine-in once lockdown is lifted?

An unparalleled source of the UK restaurant market intelligence

This report combines the data from 78,000 surveys across the year from Lumina Intelligence’s well established Eating Out Panel, a nationally representative monthly sample of 6,500 shoppers; menu insight from our Menu Tracker analysis tool – a database of over half a million menu items from over 150 eating out brands; and operator turnover and outlet data for 140+ leading branded restaurant operators from Lumina Intelligence’s Operator Data Index.

Get more information about the report

Download the preview brochure to access the sample slides and the full table of contents.