Published January 2020. In 2019 only 2.5% of sports nutrition products explicitly target women, a shockingly low number given the ever-growing proportion of women pursuing active lifestyles and interested in the benefits sports nutrition can offer them.

Detailed Lumina Intelligence market data collected in 20 countries reveals a young market ripe for expansion if oft male-led firms can get their formulations and marketing right in the #fitspo era..

The report provides keys to understanding reviews and ratings, breaks down the major brands, formulations, marketing and science to bring the sector into focus with fresh data and analysis.

€1,900

What this report gives you:

- An executive summary of key statistics.

- Setting the scene: How does female empowerment feed sports nutrition growth? How do existing products targeting women perform compared to the sports nutrition category as a whole?

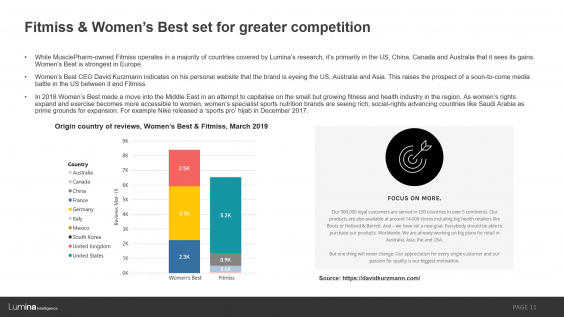

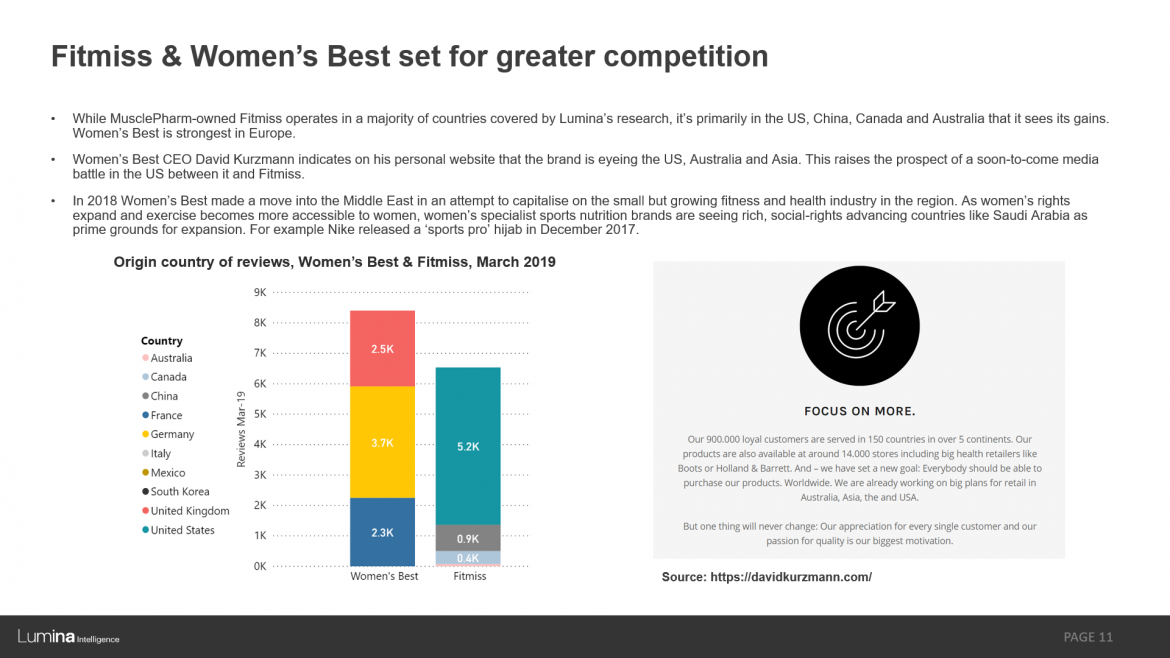

- Which countries and brands are currently capitalising on this niche, including case studies on MusclePharm’s Fitmiss range, Women’s Best, Myprotein, Grenade and more.

- Growth opportunity in the womens’ sports nutrition category, including pricing, consumer satisfaction and product formulation analysis.

- Deep-dive on existing brands’ strategies for targeting women including main brand archetypes – and examples of what attributes underpin successful products in each group.

- Key lessons in marketing sports nutrition products to women – illustrated with real-world case studies from across the globe. Includes recommendations for social media platforms like Instagram and an introduction to influencer marketing.

- Product formulation deep-dive: What vitamins, botanicals and health claims resonate best with this audience and how this differs regionally.

- Conclusions and recommendations.

Quick facts:

- The market for women’s products is young, making it prime for disruptor brands. Only 2.5% of products explicitly targeted women as of March 2019. Japan (5.9% of sports nutrition products), France (4.7%) and Australia (4.1%) had the highest proportion of women’s products.

- Female-focused products saw high customer review volume growth (+22%, 7% higher than sports nutrition average) but high turnover (11.9% of products withdrawn) between September 2018 and March 2019.

- The women’s market is dominated by just two specialist brands – Women’s Best and Fitmiss. Between them they capture 68% of all reviews in the sector.

- Products targeting women cost on average 4.3% more per 100g (creatine supplements cost 110% more per 100g), but score 0.11 fewer stars in product reviews. The category which scores best is BCAA’s (0.04 stars better than category average), and worst is pre-workout blends (0.35 stars worse than category average).

Preview – 2 slides of 56:

Chapters

- Market landscape

- Brands strategies

- Marketing

- Product positioning and science

- Conclusions and recommendations

Got questions about the sports nutrition market?

We examine the key players, trends and target consumers in 20 countries, as well as explore how Lumina can help you form a fact-based business or NPD strategy.