John Lewis Partnership:

John Lewis Partnership (JLP) marked a return to profitability at both operating and pre-tax levels for its latest financial year.

Operating profits came in at £147m for the 2023 financial year to 27 January 2024, compared to a £150.9m loss for FY2022.

Waitrose

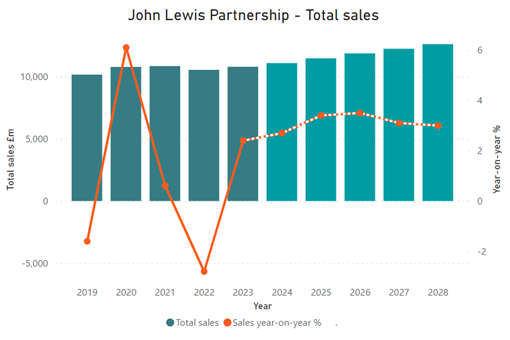

An improved performance from JLP’s grocery business Waitrose, helped offset declines in the John Lewis department store chain in FY2023. Total Partnership sales edged up 2.4% to £10,783m, driven by Waitrose where net sales climbed 5.8% to £7,139m.

However, total sales volumes at the grocer declined by 1.5% on the previous year, with increased revenues driven by average item prices rising 6.6%.

Yet Waitrose said it had seen volume growth return for four months of the second half of the year, driven by its ‘New Lower Prices’ campaign.

John Lewis

The department store, in contrast, had a subdued year, with revenues declining for a second year, falling 3.7% to £3.644m in FY2023. While Fashion and Beauty sales climbed year-on-year, John Lewis conceded that its Home and Technology sales had been “weaker”.

Despite its decline in sales, the department store attracted a record 13.4 million customers over the year, “underlining the reach of the brand”.

Investing in the future

JLP announced plans to invest £542m into the business this year, a significant step up from £312m in 2023. It says it is “laser focused on providing a brilliant retail experience for our customers”.

For the second consecutive year JLP will not pay its partners a bonus, instead investing a “record” £116m in pay, which it says will result in two-thirds of its partners receiving a near 10% pay increase.

JLP announced plans to open new Waitrose stores (the first in nearly six years) as well as refurbish 80 over the next three years. Within John Lewis its focus is on “revitalising the home category” as well as improving the online experience.