As the country navigates through post-pandemic recovery, the UK Pubs & Bars market is witnessing encouraging signs of growth and resilience. In this comprehensive analysis, we will explore the current state of the market, delve into its size, analyse growth and industry trends, and examine market share dynamics.

Market Overview

The UK economy has reached a turning point following two years of stagnation, marked by a mild recession at the end of 2023. Despite a slow start to 2024 due to weaker economic conditions, there are promising signs of recovery. GDP is forecasted to see modest growth in 2024, with expectations of around 2% growth through 2025 and 2026. This positive outlook is driven by several key factors, including falling inflation, improving real wages, and anticipated tax cuts, which collectively are set to enhance consumer spending.

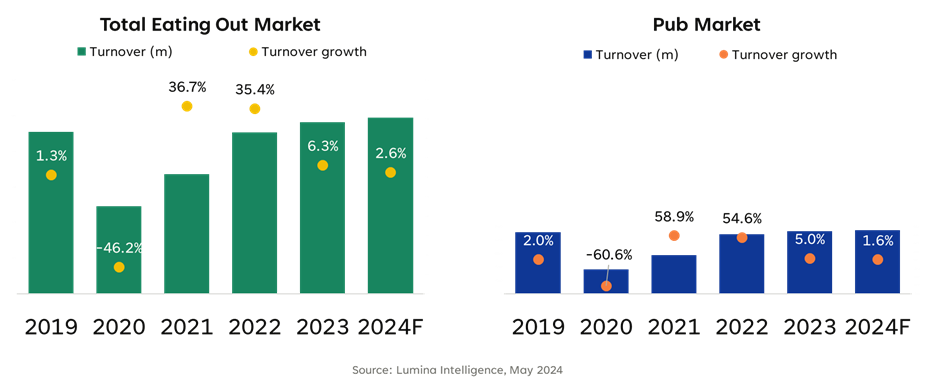

The early part of 2024 has already shown a rebound, with consumer confidence edging forward by two points in April, marking the first improvement in three months. Although consumer sentiment remains cautious, the stable optimism in personal finances over the next 12 months, reflecting the impact of falling inflation on household budgets and the anticipation of further tax cuts, suggests a brighter outlook. This gradual recovery is crucial for the pub market, which is forecasted to exceed its 2019 value by 3% in 2024, despite the slower overall growth of 1.6% compared to the total eating out market at 2.6%.

Market Size

The UK Pubs & Bars market has experienced significant fluctuations over the past few years, reflecting broader economic conditions and consumer behaviours. Prior to the pandemic, the market was robust, driven by strong consumer spending and a thriving social culture centred around pubs and bars. However, the pandemic caused a severe contraction, with many establishments forced to close their doors due to lockdown measures and reduced consumer confidence. Headlines highlighted the grim reality, with statistics showing between 20-30 pubs closing weekly during the height of the pandemic.

As the economy began to recover, the market also started to stabilise. The current state of the market in 2024 is promising, with forecasts indicating that it will exceed its 2019 value by 3%. This recovery, though slow, is a positive sign that the sector is regaining its footing.

Market Growth

The growth trends in the UK Pubs & Bars market reflect a broader narrative of economic recovery and changing consumer behaviours. During the pandemic, the sector experienced significant downturns, with many establishments struggling to stay afloat. However, as restrictions eased and consumer confidence slowly returned, the market began to show signs of recovery.

In recent years, growth has resumed, driven by improving economic conditions and increasing consumer confidence. Falling inflation and rising real wages have contributed to a more favourable economic environment, encouraging consumer spending on non-essential items such as dining out. The forecast for the market is positive, with an expected growth rate of 1.6% in 2024. Looking ahead, more substantial recovery is anticipated through 2025 and 2026, supported by continued economic improvements and a return to more normal economic activity.

Several factors are influencing this growth. Economic conditions are a primary driver, with lower inflation and higher real wages boosting consumer spending power. Additionally, changing consumer preferences, with a greater focus on experiences and social interactions, are also playing a significant role. As consumers seek out more interactive and memorable experiences, pubs and bars that can offer these are well-positioned to capture a larger share of the market.

Market Share

The market share dynamics within the UK Pubs & Bars sector are complex and influenced by various factors, including the competitive landscape and evolving consumer preferences. Key operators in the market include major chains as well as independent pubs, each vying for a share of the consumer’s wallet.

In recent years, the market has seen significant shifts. During the pandemic, many smaller establishments were forced to close, leading to a consolidation in the market. Larger operators, with more resources and the ability to adapt to changing conditions, have been able to stabilise and even expand their presence. This has resulted in a more concentrated market, with a few key players dominating the landscape.

Pubs with rooms and experiential venues are also gaining traction. These models offer unique value propositions that appeal to a broad range of consumers. Pubs with rooms, for example, cater to the increasing demand for staycations and tourism, providing a unique blend of hospitality and accommodation. Experiential venues, on the other hand, focus on creating immersive and memorable experiences, attracting patrons seeking more than just a place to grab a drink.

Conclusion

The UK Pubs & Bars market is on a path to recovery, showing resilience and adaptability in the face of significant challenges. The sector is poised for growth, driven by improving economic conditions, changing consumer behaviours, and innovative business models. While the road to full recovery may be slow, the forecast for 2024 and beyond is positive, with gradual improvements expected to support sustained growth.

As the market continues to evolve, stakeholders must remain agile and responsive to emerging trends and consumer preferences. By focusing on creating unique and memorable experiences, diversifying offerings, and leveraging economic improvements, pubs and bars can navigate the challenges ahead and thrive in the post-pandemic landscape. The next few years will be critical in shaping the future of the UK Pubs & Bars market, and those who can adapt and innovate will be well-positioned to capture the opportunities that lie ahead.